KEY POINTS: Home Equity

• The equity in your home represents the success of your real estate investment.

• Learn how to calculate your home's equity and what you can use it for to build wealth.

• Identify 3 ways for how to increase the equity in your home.

I often say to my clients, "A home is more than a roof over your head; it's also an investment."

In fact, it's the largest investment that most people ever make.

However, the success of that investment is measured by your home equity.

Home equity refers to the difference between the current market value of your home and the outstanding balance on your mortgage. This equity can be a valuable asset that can be leveraged in a number of ways.

Let's discover how to calculate your home's equity, what you can use it for, and how to increase your home's equity in 2026.

Home Equity Calculation

You could certainly use a home equity calculator, but the equation to calculate it is very easy:

Home Value - Mortgage Balance = Home Equity

Let's look at an example.

If your home is currently worth $300,0000 and you owe $200,000 on your mortgage, you currently have $100,000 in home equity ($300,000 - $200,000 = $100,000).

So What is Your Home Worth?

Determining the value of your home is the first step to calculating your home equity.

There are three primary ways to determine the value of your home: get an appraisal, talk with a local realtor, or use online tools.

The first step in calculating your equity is getting a current value of what your home is worth.

1. Appraisal

The first way to determine the value of your home is through a professional appraisal, which involves a detailed inspection of your property and an analysis of recent sales of similar properties in your area.

This professional service typically costs $300 to $1,000 depending on the home and factors involved to complete the appraisal. Be sure to hire a local appraiser who is familiar with home sales in your location.

2. Real Estate Agent

A second option is to contact your real estate agent and to ask for a "CMA," which stands for Comparative Market Analysis.

You can think of a CMA as a mini-appraisal, and it won't cost you anything. Like a professional appraisal, a CMA uses comparable homes to estimate your home's value. Additionally, because the CMA is created by your real estate agent who knows your home and how to compare it to nearby properties, it is likely to be more accurate than any online estimation tools.

3. Online Tools

A final option is to use online tools that provide estimates based on recent sales data. An example is Zillow's Zestimate.

However, keep in mind that these estimates are often just a starting point and may not be entirely accurate. Obviously, the algorithms of these online tools cannot account for things like your home's condition, age of major systems, or other factors that can't be measured in public data.

How to Find Your Mortgage Balance

The easiest way to find your mortgage balance is to check your most recent statement or contact your lender directly.

Your statement will typically show your current balance as well as the principal and interest portions of your payment. If you don't have access to your statement or can't find it, you can also log into your lender's online portal or mobile app to view your account information.

Another option is to call your lender and request your balance over the phone.

Finally, if you have made the required mortgage payment each month since you owned the home, and you have not made any additional payments to the principal balance, you can also check your loan amortization schedule.

This schedule, which you likely reviewed when signing your mortgage documents at closing, shows the remaining mortgage balance after each payment.

If all else fails, and you remember the terms of your mortgage, you can simply plug the information in a mortgage calculator and see the associated amortization schedule.

Reasons Why You May Need to Calculate Home Equity

Now, after determining your home's value and understanding your remaining mortgage balance, you have calculated your home equity.

But other than the knowledge of it, why is home equity important?

Getting Rid of PMI: If you used a conventional loan to purchase your home, and you put down less than 20%, you are paying for private mortgage insurance (PMI). However, when your home equity reaches 20%, you can request to remove PMI from your home loan. This is a significant savings for you.

Using a HELOC: A Home Equity Line of Credit, or HELOC, is a type of loan that allows homeowners to borrow against the equity they've built up in their home. Essentially, a HELOC acts as a revolving line of credit that you can draw from as needed, much like a credit card. The amount you can borrow is based on the equity you have in your home. HELOCs can be a useful tool for homeowners who need to borrow money for home improvements, debt consolidation, or other major expenses.

Cash-out Refinance: A cash-out refinance is a type of mortgage refinance in which the borrower replaces their existing mortgage with a new one that has a higher loan amount. The difference between the old and new loan amounts is then paid out to the borrower in cash. Essentially, a cash-out refinance allows homeowners to tap into the equity they've built up in their home and convert it into cash.

Plan to Sell: If you plan to sell your home and perhaps want to purchase a new one, you may want to understand how much equity you have in your current home that you can use to purchase your new one. Keep in mind, however, that you will still have closing costs when selling your home, so be sure to subtract these estimated closing costs from your home equity amount in order to determine your actual net proceeds.

How to Increase Home Equity

There are several ways to increase the equity in your home.

1. Make Extra Payments to your Mortgage's Principal Balance

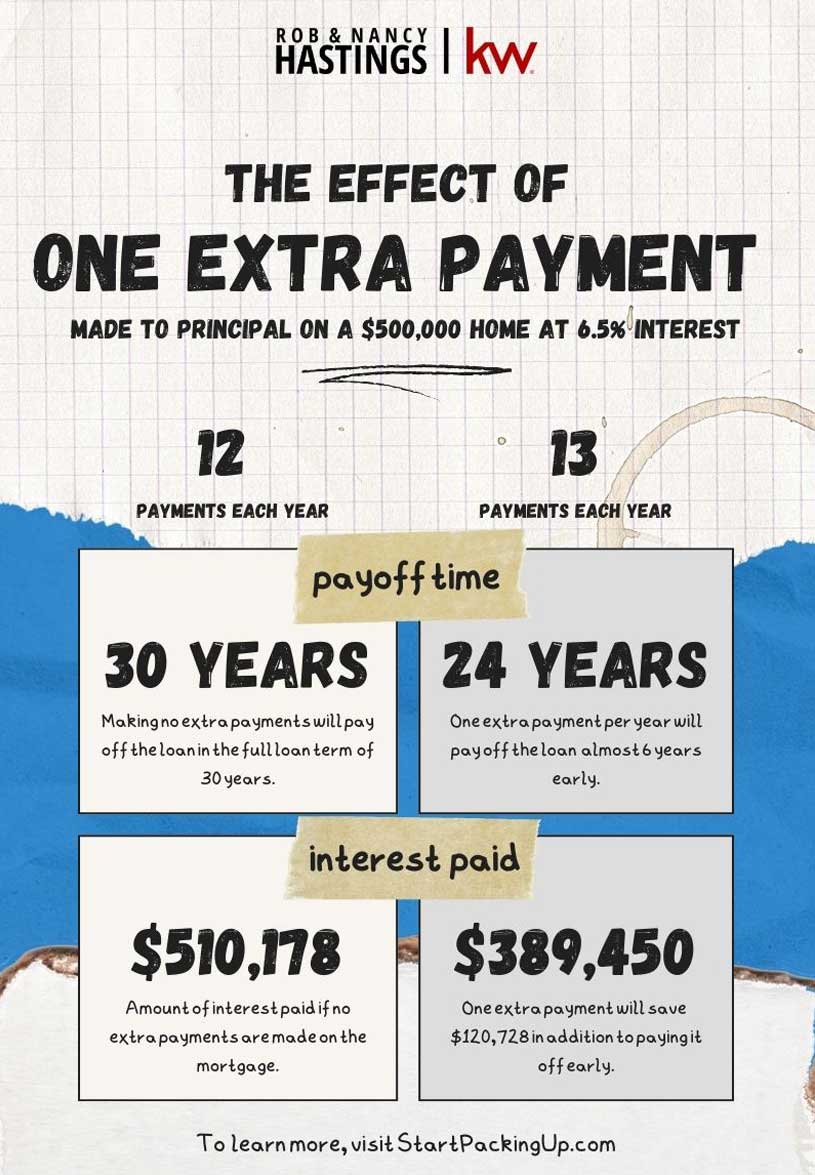

Making extra mortgage payments is one effective way to increase your home equity and pay off your mortgage faster.

By making additional payments towards your principal balance, you can reduce the overall amount of interest you'll pay over the life of the loan and build equity more quickly.

One strategy is to make bi-weekly payments instead of monthly payments, which can add up to an extra payment each year. Another option is to round up your monthly payment to the nearest hundred or thousand dollars, which can help you pay off your mortgage faster and reduce your interest costs.

Finally, you can just make one extra payment per year at a time that's best for your financial situation such as when you receive your tax refund or receive an annual bonus from your employer.

To see savings for your loan amount and specific interest rate, visit this amortization calculator from US Bank.

It's important to check with your lender to ensure that any additional payments you make are applied to your principal balance and not just your next scheduled payment.

By making extra mortgage payments, you can build equity in your home more quickly and save money on interest costs over the life of the loan.

2. Home Improvements

Improvements to your home are another effective way to increase your home equity.

By upgrading your home with improvements that add value, you can increase the resale value of your home and build equity over time.

Some smart home improvements that can boost home equity include upgrading the kitchen or bathrooms, adding a pool, building an addition or garage, and improving curb appeal with landscaping or exterior updates.

It's important to focus on improvements that will provide a return on investment and avoid over-improving for your neighborhood or market. Consider consulting with your real estate agent before making any home improvements so you can be sure those improvements will increase value in your local market.

By making smart improvements, you can increase the value of your home and build equity over time, which can help you achieve your long-term financial goals.

3. Consider Refinancing into a 15-year Mortgage

Refinancing into a 15-year mortgage is a smart strategy for increasing your home equity during the course of your ownership.

With a shorter loan term, you'll be able to pay off your mortgage faster and build equity more quickly. Additionally, 15-year mortgages typically have lower interest rates than 30-year mortgages, which can save you thousands of dollars in interest costs over the life of the loan.

To take advantage of this strategy, you'll need to qualify for a 15-year mortgage and have the ability to make higher monthly payments. It's also important to consider the impact of the higher payments on your monthly budget, the costs of refinancing, and current interest rates.

Bottom Line

Your home's equity represents the success of your real estate investment, and calculating your home equity is an important step in building long-term wealth.

By understanding how much equity you have in your home, you can make informed decisions about refinancing, making improvements, and tapping into your equity for smart purchases.

The key word here is "smart" - never use your home's equity to create more debt, fund things like a vacation, or purchase material things outside of your means.

With careful planning and a long-term perspective, you can successfully leverage your home equity to achieve your financial goals.