Case Study: Is Opendoor Really Making Any Money in Jacksonville?

Published on MARCH 8, 2023 by ROB HASTINGS

CATEGORIES: Real Estate News | Real Estate Investing

Introduction: A Case Study of Opendoor

Over the past few months, I have shown several Opendoor homes for sale in Jacksonville’s real estate market.

After showing a few of these homes, I began to notice some commonalities:

(1) Most of the homes had been on the market for 100 days or more

(2) Several homes had multiple price reductions since they were first listed

(3) Many homes were currently priced less than what Opendoor bought them for.

It made me wonder:

Is Opendoor really making any money in Jacksonville?

I had to find out.

Who is Opendoor?

Opendoor is a technology-driven real estate company founded in 2014 that aims to simplify the process of buying and selling homes.

The company operates an online platform that allows homeowners to request a cash offer for their homes, receive a competitive price, and close the sale in as little as a few days without having to use a real estate agent. Opendoor uses data and analytics to determine the value of homes and provide offers to homeowners.

Like its competitors (OfferPad and previously Zillow and Redfin), Opendoor is often referred to an "iBuyer" – a term coined for large, venture capital-backed companies looking to disrupt the traditional real estate process of how buyers and sellers exchange homes.

Opendoor operates in more than 53 markets across the United States, including Jacksonville, and has expanded into mortgage lending as well as title services.

Opendoor’s Process of Buying and Selling Homes

Opendoor attempts to provide homeowners with a simple and hassle-free way to sell their homes.

To start the process, a homeowner can visit the Opendoor website and enter his or her address as well as some basic home information. Within 24 hours, Opendoor will provide the homeowner with a cash offer based on market data and a proprietary valuation model.

If the homeowner accepts the offer, he or she can choose the closing date, avoid repairs, not pay any real estate commissions, and Opendoor will handle all the paperwork.

The company charges 5% of the purchase price as a service fee for this convenience. They will also estimate for any repairs and deduct these costs from the proceeds of the sale.

When Opendoor closes on the home with the seller, the closing costs for the seller and the buyer (Opendoor) follow the standards of the local real estate market.

In Jacksonville’s market, this means that the seller of the home pays the costs of the deed stamps (transfer taxes), owner’s title insurance, survey, prorated property taxes, and prorated HOA fees, among various other fees. Meanwhile, since Opendoor is purchasing the home with cash, the company’s closing costs are typically just deed recording fees.

After purchasing the home, Opendoor prepares the home for sale. This time period varies based on the home’s condition and any necessary repairs prior to bringing the home to market.

Opendoor operates in more than 53 markets across the United States, including Jacksonville.

Opendoor uses its own brokerages in its established markets to list and sell its properties.

When the home goes under contract and the buyer completes an inspection, Opendoor will often give a concession in lieu of requested repairs (if any).

Opendoor also pays real estate commissions to cooperating brokers whose agents bring buyers who purchase the company’s homes. These commissions will sometimes vary depending on the property listed.

In 2019, Opendoor acquired OS National, a title company service based in Duluth, GA, to handle all of its title work and integrate escrow services.

Opendoor closes most all homes it buys and sells with OS National.

Opendoor’s Most Recent Financial Results

In order to understand if Opendoor is actually profitable in the Jacksonville market, let’s first explore the larger macro picture of Opendoor’s performance by reviewing the company’s financial statements for the most recent financial year (2022) and quarter (Q4 2022).

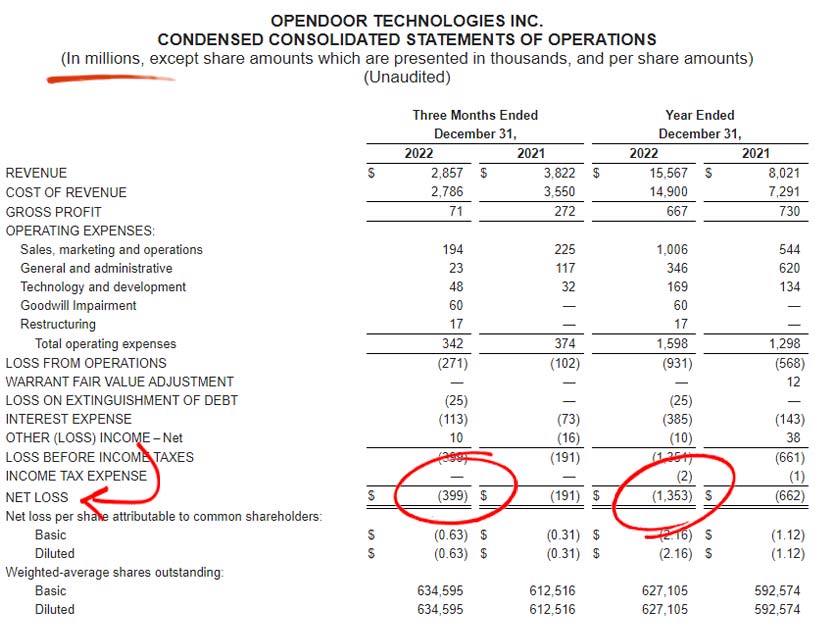

For the year ending December 31, 2022, the company sold 39,183 homes nationally and incurred a loss of $1.353 billion.

For the quarter ending December 31, 2022, Opendoor sold 7,512 homes nationally and incurred a net loss of $399 million.

Opendoor's most recent income statement shows significant net losses in Q422 and for the year.

Wow. These are some eye-opening numbers.

In fact, according to its financial statements, Opendoor incurred a loss of $6,000 on each home sold in Q4 of 2022 and $28,000 per home sold when accounting for valuation adjustments on homes still in the company’s inventory.

As we will discuss later, this will be an important metric for comparison of homes in a similar timeframe in the Jacksonville market.

Key Numbers: Revenue, Direct Selling Costs, and Holding Costs

With accurate input numbers in a simple equation, it’s easy to determine if Opendoor is flipping homes for profit in Jacksonville.

Revenue: Opendoor generates revenue on its homes in two ways: (1) The final selling price, and (2) the 5% service fee charged to the seller when Opendoor purchases the home.

Direct Selling Costs: Opendoor’s direct selling costs related to homes sold primarily include real estate commissions, concessions in lieu of repairs, external title and escrow-related fees, transfer taxes (deed stamps), and owner’s title insurance costs.

Holding Costs on Sales: Opendoor’s holding costs on its sold homes mainly include property taxes, insurance, utilities, homeowners association dues, and cleaning and maintenance costs.

With these key numbers identified, I could start collecting the appropriate data.

Data Collection

Unlike other publicly-traded companies where detailed insight into each sale of a product or service isn’t always available, the beauty of collecting data for Opendoor in the Jacksonville real estate market is that most of the data is public record.

Through public property tax records, the Multiple Listing Service, and computable costs (such as transfer taxes), it is very simple to derive meaningful data into the profit/loss of each home that Opendoor purchased and sold in Jacksonville.

I started by collecting all active, pending, and closed listings by Opendoor in MLS for the period from November 20, 2022 to February 23, 2023.

I used this sample period to explore the most recent data available pertaining to the Jacksonville market.

In addition, this sample period closed on the day that Opendoor announced its Q4 earnings, which provided me fresh data for comparison to my own results.

In total, this sample period produced 507 homes in the Jacksonville market by Opendoor. Of these 507 homes, 448 were single-family homes (88%), 39 were townhomes (8%), and 20 were condos (4%).

On average, the homes were built in 1989 with 3 bedrooms, 2 bathrooms, and were 1,617 sq ft in size.

At the time of data collection, 176 homes had sold during the sample period; the remaining homes were under contract or were active listings.

Through MLS, I also collected the following additional data for Opendoor homes:

(1) Listing Date

(2) Sold Date

(3) Days on Market

(4) Association Fees (if any)

(5) Transfer Fees (if any)

(6) Real Estate Commissions

(7) Concession Amounts (if any)

I then used public property tax records to collect these data:

(1) Date that Opendoor purchased these homes

(2) The prices they paid for them

(3) Property tax amounts for 2022

Assumptions, Estimations, & Limitations

While much of the data necessary to complete this case study is available and very accurate as explained above, some pertinent datapoints require assumptions and estimations. These datapoints include utilities, owner’s title insurance, and insurance.

To validate these three assumptions and estimations, which contribute to Opendoor’s direct selling costs (owner’s title insurance) and holding costs on sales (utilities and insurance), I compared the average of my computed direct selling costs and holding costs for the Jacksonville market to those same average costs for all 7,512 homes sold in Q4 by Opendoor as indicated in the company’s financial statements.

The difference was small ($16,789 versus $15,308), indicating that my assumptions and estimations in these cost categories were somewhat in line with Opendoor’s actual selling and holding costs.

Methodology

After compiling these data in an Excel file, including the previously mentioned assumptions and estimations, I now had the foundation to answer my case study question.

I first calculated Opendoor’s revenue on the 176 homes sold in the sample period. As mentioned previously, this revenue is defined as the final selling price of the home plus the 5% service fee that Opendoor charged to the seller when the company purchased the home.

I then calculated Opendoor’s direct selling and holding costs incurred on the homes sold during the sample period.

I could now calculate Opendoor’s profit (loss) for each home sold in the Jacksonville market during the sample period.

The detailed equation is as follows:

-

(Final Selling Price + 5% Service Fee) – Original Purchase Price – Homeowner’s Association Costs for Days Owned (if any) – Property Taxes for Days Owned – Transfer Fees (if any) – Utilities Cost – Insurance for Days Owned – Transfer Taxes (Deed Stamps) – Owner’s Title Insurance – Concessions (if any) – Real Estate Commissions = Net Profit (Loss)

Or, written more succinctly:

-

Home Revenue – Direct Selling Costs – Holding Costs = Net Profit (Loss)

Results

So, is Opendoor making any money in Jacksonville?

Yes, they are.

With a caveat...

For the 176 homes that Opendoor sold during the sample period in the Jacksonville market, my results indicate that the company profited $290,555.45 at an average of $1,650.88 per home sold.

While my data include assumptions and estimates that can impact the findings, these results do indicate that Opendoor is potentially performing better in Jacksonville than they are nationally in which they incurred a loss of almost $6,000 per home sold as mentioned previously.

However, as indicated on the Opendoor’s income statement, other operating expenses such as salaries, benefits, and stock-based compensation for Opendoor’s Jacksonville employees as well as cost of initial repairs with third-party contractors likely turn this small profit into a loss in Jacksonville.

Let’s dig into more detailed and interesting findings for Jacksonville.

Opendoor was profitable on 91 of 176 homes and incurred losses on 85 homes sold. The range of profit / (loss) was from $113,596.83 to ($76,429.56).

On average, homes sold for 87% of their original list price.

The average days on market for homes sold by Opendoor in the sample period was 126 days. By comparison, the average days on market for all properties sold in MLS during this sample period was 66 days.

The average number of days from purchase date to listing date was 27, representing that it took Opendoor approximately 4 weeks to get purchased homes ready for market.

Of the 176 homes sold, Opendoor gave seller concessions on 145 of these homes for an average of $6,298 per home.

Opendoor paid 2.5% in real estate commission to cooperating real estate brokers for 145 homes sold, 3% for 10 homes, 3.25% for 18 homes, 3.5% for 1 home, and 2% for 1 home. All homes that sold with 3.25% commission were on the market for 180 days or more, and the home that sold with 3.5% commission was on the market for 311 days.

For the remaining 331 homes that were active or pending (under contract) listings in the sample period, 124 homes (37%) were listed for less than what Opendoor bought them for.

The Effect on Opendoor’s Valuation and Stock Price

After release of its Q4 earnings on February 23, 2023, Opendoor’s stock closed at $1.60 per share on Friday, February 24, 2023 – a 12% decline from its close a day prior ($1.82).

For historical context, Opendoor went public on December 21, 2020. The company priced its initial public offering (IPO) at $29 per share.

The stock hit an all-time high on February 11, 2021 at $39.24.

As a result, the stock price on Friday, February 24, 2023 of $1.60 represents a 95.92% decline from its all-time high just two years ago.

Likewise, the company’s market cap declined from $20.58 billion to $1.028 billion in the same period.

These losses in 2022 are despite the company experiencing a 94% year-over-year increase in revenue in 2022 to $15.567 billion while selling 80% more homes than in 2021.

How did this happen?

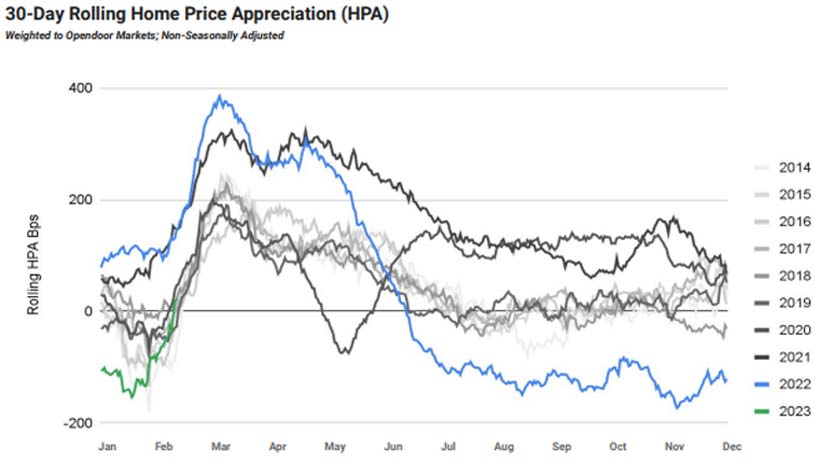

Opendoor looks at 2022 as the "tale of two halves."

The company’s acquisition pace reached an all-time high as it expanded its business and even turned a profit in the first quarter of 2022. Their aggressive purchasing was driven by housing transaction volume, velocity, and home price appreciation – all of which were at historical highs.

The blue line, which represents 2022, is Opendoor's "tale of two halves."

But as the market shifted in the second half of 2022, Opendoor admits that they did not appropriately predict the rapid decline in home price appreciation which was driven by the Federal Reserve’s tightening policy to tamp down inflation in the economy.

The result was a pile of home inventory – a collection of homes purchased between March and June 2022 and dubbed by Opendoor as the "Q2 Cohort" - that Opendoor couldn’t sell for profit. They quickly prioritized selling off this dead inventory at a significant loss in addition to implementing other cost-cutting measures such as laying off 18% of their workforce in November 2022.

The Endgame Vision for Opendoor

Opendoor currently offers two core products: "1P" and "3P."

1P refers to first-party transactions in which Opendoor purchases homes directly from sellers and resells those homes directly to buyers. Currently, this is their core business product as well as the product I analyzed in this case study for Jacksonville.

Alternatively, 3P refers to third-party transactions in which Opendoor connects sellers with its buyers and facilitates the transactions without acting as a principal. The company envisions this 3P process when it looks forward in the next 10 years to be "similar to or the same as booking a flight, buying a car, or hailing a ride."

In 2022, Opendoor launched Opendoor Exclusives in Dallas / Fort Worth, Texas and has since expanded this 3P product to two other cities in Texas (Houston and Austin). The company charges the same 5% service fee for each 3P transaction while also monetizing services such as title and escrow.

Opendoor likely sees benefit in this model by:

(1) Not actually owning any home inventory,

(2) Eliminating direct selling costs and holding costs that are required in the 1P product,

(3) Reducing human resource requirements and third-party services in local markets, and

(4) Reducing the effects of high-risk factors such as macro-economic shifts or changing interest rates.

On December 1, 2022, Eric Wu, a co-founder of Opendoor, stepped down as CEO.

The reason?

-

Over several years, I built conviction that our third-party (3P) marketplace is what homebuyers and sellers need, will fundamentally change how all homes are transacted and is a critical piece of Opendoor’s future.

Thus, I’ve made the decision to [step down from the CEO position and] focus my time and energy on building and delivering on this vision.

-Eric Wu, Opendoor Co-Founder and former CEO

The 3P product is the endgame vision for Opendoor. It's a shift from their low-margin house flipping model to a high-margin marketplace business.

Lessons Learned for Buyers & Their Real Estate Agents

1. For a good deal from Opendoor, find a Q2 Cohort home.

Currently, the best deals on Opendoor homes will likely be those that are part of the Q2 Cohort (homes that Opendoor purchased between March and June of 2022). Opendoor has been clear that they desire to sell the remaining 40% of homes they still have in their inventory from this time period as quickly as possible.

Find a Q2 Cohort home from Opendoor (send me an email if you want a list of these homes) and make an aggressive offer. The chances that this offer gets accepted are likely high given the company’s public statements and evidence in recent sales.

2. Ask for ridiculous seller concessions after home inspections.

As mentioned, Opendoor gave seller concessions on 144 out of 176 homes sold in the Jacksonville market during the sample period at an average of $6,298 per home.

In the past year, the three largest concessions given by Opendoor in Jacksonville have been $66,978, $34,642, and $29,400. This is wild money that traditional sellers wouldn’t like concede.

When under contract on an Opendoor home, hire a thorough home inspector who will identify as many issues as possible – big or small. Then, present this home inspection report to Opendoor and ask for a large concession in lieu of repairs.

Conclusions

There are several reasons why this small case study is important.

1. Opendoor is the largest iBuyer in the nation.

Will Opendoor and other iBuyers be able to weather this real estate market shift, or will Opendoor be seen as just another failed attempt to disrupt the traditional real estate model?

2. The company is also the largest iBuyer in the Jacksonville real estate market.

As the largest iBuyer in Jacksonville’s market, we must consider the effects of how Opendoor is handling its inventory and sales. The company’s practices affect our local market norms, competitive practices, and real estate comparable sales.

3. Without saying it explicitly, Opendoor wants to eliminate real estate agents, flippers, wholesalers, and other players in the real estate industry.

This may not be a bad thing!

But since this would kill, you know – my job – maybe I better pay attention.

ABOUT THE AUTHOR:

Rob Hastings is a top-producing real estate agent in Jacksonville, Florida and helps buyers, sellers, and investors of homes and property throughout all of Northeast Florida. He works with his wife Nancy as a husband-and wife-team with Keller Williams Realty Atlantic Partners. When not helping his clients navigate the real estate process, Rob enjoys working on old Corvettes and playing music (guitar and piano). A U.S. Naval Academy graduate and former Naval Officer, he also loves boating and simply spending time on the water.

Notes on Assumptions and Estimations:

Utilities: To estimate utilities, I considered the use of water, sewer, and electric as serviced by Jacksonville Electric Authority (JEA). Because Opendoor’s homes are vacant, I assumed 0 gallons of water and sewer usage for each home. However, JEA still charges a basic monthly fee and franchise fee for both water and sewer services in addition to a public service tax on water services. In total, the charges for water and sewer, even with 0 gallons of usage, amount to $43.20 each month for each home. For electric, I estimated 100 kWh of electric usage per month. This is a conservative estimate to account for minimal heating and cooling as well as other small electrical consumption for an electric water heater, refrigerator, and lights. JEA has a basic monthly fee for electric, and the utility company bills energy use at the rate of $0.07171 per kWh. They also charge fees for fuel costs, environmental charges, franchise fees, gross receipts taxes, and public service taxes. After calculating the costs for water, sewer, and electric, I used this estimated utility bill to calculate a daily utility rate for Opendoor’s vacant homes. I then multiplied this rate by the number of days Opendoor owned each of the homes to determine the company’s holding costs for utilities of each home.Owner’s Title Insurance: Title insurance in Florida is regulated by the Florida Department of Finance and has a promulgated rate. Likewise, since Opendoor owns these homes for less than 3 years, they receive a reissue rate credit when they sell the home. Both the title insurance policy amount and the reissue rate are easily calculated. However, since Opendoor acquired OS National as a wholly owned subsidiary for its title and escrow services, the total cost of the title insurance policy cannot be considered a direct selling cost. The commission splits between a title company and underwriter can vary, but I have assumed an 80/20 split with 80% of the owner’s title insurance policy premium going to OS National Title and 20% being paid to the third-party underwriter. I included this 20% as a direct selling cost.

Insurance: For insurance, I have assumed that Opendoor self-insures its properties. Moreover, it is likely that Opendoor carries liability insurance for its portfolio of homes to protect against injury of homebuyers or others on the properties, but I can’t find any reference to such insurance or any associated cost in the company’s financial statements. Therefore, an estimation for any type of insurance is not accounted for in my analysis of Opendoor in the Jacksonville market.