FHA Mortgages Just Got More Affordable

Published on FEBRUARY 25, 2023 by ROB HASTINGS

CATEGORIES: Real Estate News | Mortgages and Financing

-

KEY POINTS: FHA Loan MIP Reduced

• The Federal Housing Administration just reduced the cost of mortgage insurance premiums.

• Learn the requirements of an FHA Loan and how this type of loan compares to a conventional mortgage.

• Explore how the new mortgage insurance premium will work on new FHA loans.

• Find out when the reduced mortgage insurance premium will take effect.

The Federal Housing Administration (FHA) has recently announced a reduction in mortgage insurance premiums for new borrowers.

The reduction, from 0.85% to 0.55%, is expected to make homeownership more affordable for first-time buyers and other borrowers who use FHA loans to purchase a home.

In this article, we will discuss what FHA loans are, how the mortgage insurance premium works, what the reduction means for new borrowers, and when the change goes into effect.

What are FHA Loans?

FHA loans are mortgages that are insured by the Federal Housing Administration. Specifically, they are popular among first-time homebuyers and other borrowers who may have difficulty qualifying for conventional mortgages. FHA loans are also attractive to borrowers because they typically require a lower downpayment and credit score than other mortgage loan types.

FHA loans are often used by home buyers who have a minimum credit score of 580 (or from 500-579 with a 10% downpayment with some lenders). This is because FHA loans are designed to assist borrowers with lower credit scores or limited funds for a downpayment.

In addition, FHA loans are more lenient for past credit issues, to include bankruptcy, foreclosure, and short sales, than conventional loans.

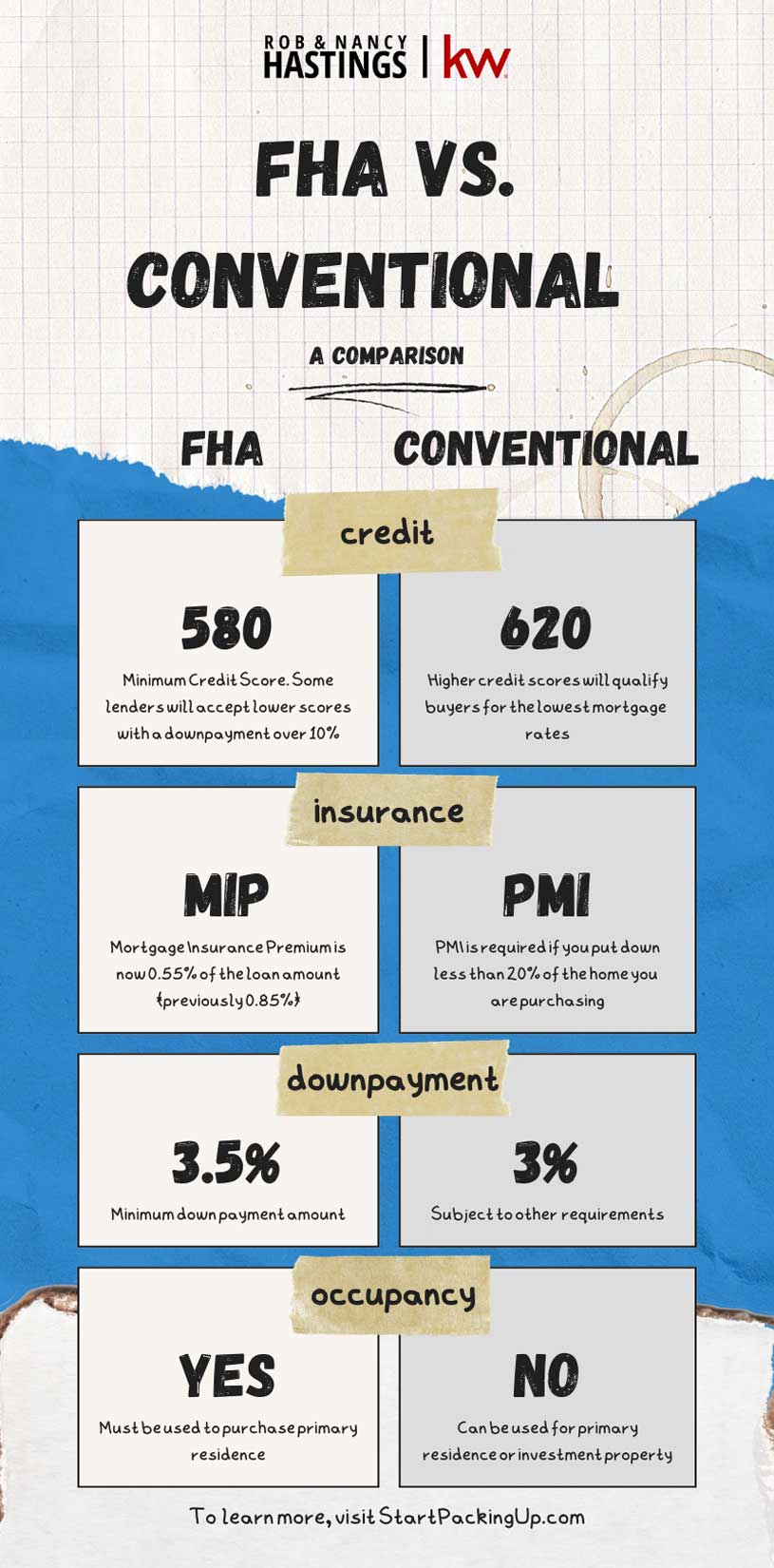

Infographic: FHA Loans and Conventional Loans both have their pros and cons depending on a borrower's personal financial situation when purchasing a home.

How does Mortgage Insurance Premium (MIP) work on FHA Loans?

Mortgage Insurance Premium (MIP) is an insurance policy that borrowers must pay on FHA loans. The purpose of MIP is to protect lenders in case the borrower defaults on the loan.

MIP is paid in two parts:

(1) an upfront premium

(2) and an annual premium

The upfront premium is typically 1.75% of the loan amount and is paid when closing on the home. The annual premium is divided into monthly payments and is based on the loan amount, the loan term, and the loan-to-value ratio (LTV). The LTV is the ratio of the loan amount to the appraised value of the home.

Under the previous guidelines, new FHA borrowers would pay an annual MIP of 0.85% of the loan amount. This meant that if a borrower took out a $325,000 loan, they would pay an annual MIP of $2,762.50 or $230.20 each month.

What does the reduction in MIP mean for new borrowers?

The reduction in MIP means that new FHA borrowers will pay a lower annual premium of 0.55% of the loan amount - a drop of 30 basis points.

Utilizing the same example of a $325,000 loan, a new borrower would pay an annual MIP of $1,787.50 or $148.95 each month. As a result, this is a significant reduction from the previous MIP rate of 0.85% and a large savings for FHA borrowers.

The reduction in MIP will make FHA loans more affordable for home buyers, specifically first-time buyers who may be struggling to save for a down payment or who have lower credit scores. The lower MIP rate will also make FHA loans more competitive with conventional loans, which do not require MIP but typically require higher credit scores and larger down payments.

The White House made the announcement on February 22, 2023, and here's what they had to say about the reduction of MIP in their press release:

-

At a time when budgets are tight and homeownership is out of reach for too many, FHA's premium reduction will allow more households to access the stability and wealth creation of homeownership, particularly the first-time homebuyers and families of color who rely heavily on affordable FHA-insured mortgages.

For many families, the savings will make the difference in their ability to purchase the home of their choice.

-Julia Gordon, Assistant Secretary for Housing and Federal Housing Commissioner

When does the change go into effect?

The reduction in mortgage insurance premiums for FHA loans will go into effect on March 20, 2023.

This means that new borrowers who obtained an FHA loan on or after that date are eligible for the reduced MIP rate of 0.55% for the annual premium.

However, borrowers who obtained an FHA loan prior to March 20, 2023 will continue to pay the previous MIP rate of 0.85% for the duration of their loan unless they refinance into a new FHA loan with the reduced MIP rate.

Bottom Line

The reduction in MIP for new FHA borrowers is a positive development for people who are considering buying a home in this real estate market where mortgage rates have essentially doubled in the past year.

For home buyers who are considering a FHA loan for their home purchase, it is important to discuss these changes with a trusted lender to determine how these changes will affect the monthly mortgage payment.

Related Articles:

5 First Time Home Buyer Mistakes to Avoid

ABOUT THE AUTHOR:

Rob Hastings is a top-producing real estate agent in Jacksonville, Florida and helps buyers, sellers, and investors of homes and property throughout all of Northeast Florida. He works with his wife Nancy as a husband-and wife-team with Keller Williams Realty Atlantic Partners. When not helping his clients navigate the real estate process, Rob enjoys working on old Corvettes and playing music (guitar and piano). A U.S. Naval Academy graduate and former Naval Officer, he also loves boating and simply spending time on the water.